SpeechService

The aim of the social media/PR activities was to inform first-time homebuyers of new possibilities for financing their personal contribution – and it worked. Thanks to relevant targeting on Funda and Facebook, our message reached the first-time buyers who are actively in market. The eye-catching way in which we did it meant there was a positive sentiment to the message. Through news and regional media, the campaign reached an enormous amount of people, with a total free publicity value a little over 1 million euro’s (Zandbeek).

We not only want to inform first-time buyers about the tax-friendly ways of financing the compulsory personal contribution, but also help them take the first step. And this is to talk to their parents about a possible loan. It’s a difficult subject to broach and you need good arguments and conviction. A real world leader worthy speech.

To help first-time buyers get onto the housing market, we called in the help of a very special writer. A writer that got the whole world listening and brought one person’s dream to life with a single speech. Clarence B. Jones, the writer of the most famous speech of all time: Dr Martin Luther King’s “I have a dream” speech.

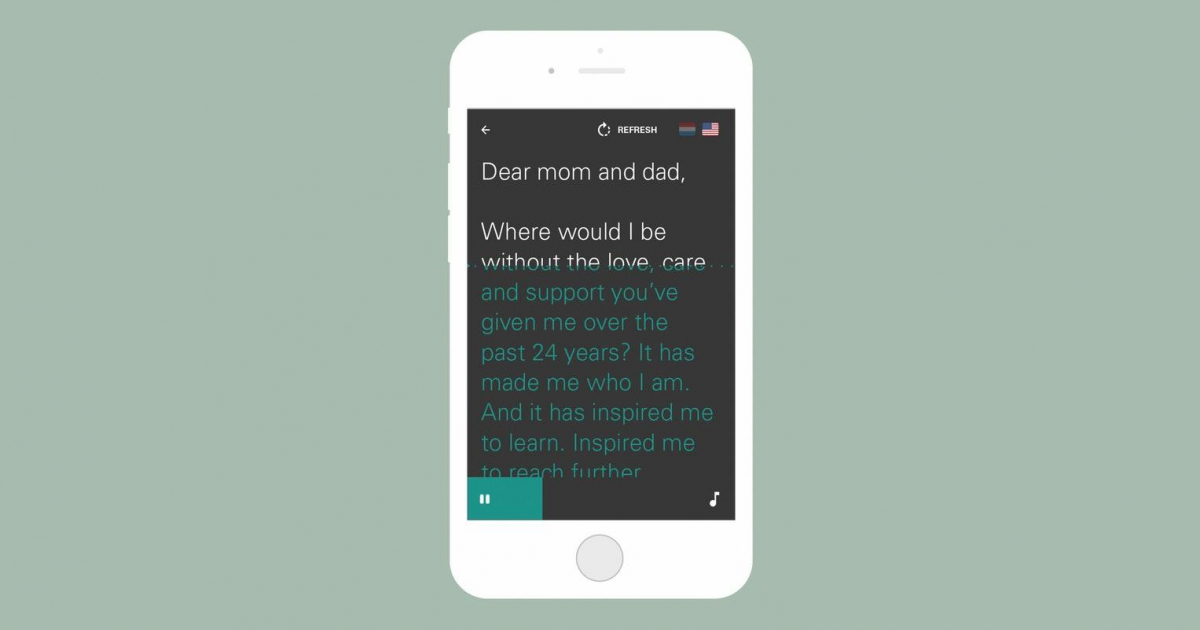

The ABN AMRO Speech Service is an online tool that brings the normally inaccessible art and skills of a real speech writer to every first-time homebuyer. With Clarence B. Jones you personalise your speech, turning it into a strong, emotional story. A push in the right direction and the best possible way of convincing the potential lender of the importance of you having your own first home.

As of 2015, you need to put your own money or savings towards the costs of buying a house. These tighter rules for the housing market mean that, along with rising house prices, it’s become very difficult for first-time buyers to buy their first home. And the lack of savings is made painfully clear by the 28% drop in mortgages for first-timer buyers.

Fortunately, there are alternatives ways of getting the necessary finances. For instance, attractive personal loans that offer tax benefits for both the lender and the borrower. With this campaign, we want to draw first-time buyers’ attention to these alternatives and position ABN AMRO as the bank for first-time homebuyers. A bank that uses its expertise to their advantage and, in line with its own brand mission, “bring their goals closer.”